Greek Hospitality Industry Performance - 1st Quarter 2012

Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

% Change in International arrivals1 in Greek airports, 2012 compared to 2011

Region |

% Change Q1 |

% Change YTD Q1 |

| Athens |

-15.6% |

-15.6% |

| Thessaloniki |

7.7% |

7.7% |

| Rest of Greece |

-3.7% |

-3.7% |

Source: SETE, processed by GBR Consulting

% Change in RevPAR2 in Greek hotels, 2012 compared to 2011

Region |

% Change Q1 |

% Change YTD Q1 |

| Athens |

-14.1% |

-14.1% |

| Thessaloniki |

12.5% |

12.5% |

| Resort |

-19.4% |

-19.4% |

Source: GBR Consulting

RevPAR in Competitive Destinations, 2012 compared to 2011

Region |

% Change Q1 |

% Change YTD Q1 |

| S. Europe |

2.3% |

2.3% |

| Rome |

1.6% |

1.6% |

| Madrid |

-2.2% |

-2.2% |

| Cairo |

4.9% |

4.9% |

Source: STR Global, processed by GBR Consulting

Commentary

- International tourist arrivals at main Greek airports showed in Q1 an overall decline of 8.8% compared to Q1 of 2011. Athens, which accounts for over two third of all arrivals this quarter, showed a significant drop of 15.6%. The rest of Greece saw a drop of 3.7%, due to a lower number of arrivals at the airport of Rhodes and Kos. Thessaloniki, however, continuing on its capitalisation of the opening of new markets, saw a 7.7% increase in arrivals in Q1 compared to Q1 in 2011.

To reverse the trend, Athens International Airport announced late April a financial support package for airlines for the summer season (Apr-Oct), amounting to ~20% of total charges. The package includes discounts on landing and parking fees, as well as subsidies for transfer passengers and new routes.

- Hotel performance follows the pattern of international arrivals. Hotels in Athens had a difficult first quarter with occupancies falling by more than 10% mainly as a result of the collapse of the MICE market. In combination with falling prices, RevPAR dropped by 14.1% in Q1 compared to Q1 last year. Hotels in Thessaloniki saw a sharp increase in occupancy levels, while prices fell somewhat, resulting in an overall increase of RevPAR of 12.5%. Finally, resort hotels had a slow start this year with falling RevPAR of 19.4% compared to Q1 of 2011. This also reflects the impact of the Greek economic recession on domestic tourism.

- At competitive destinations, we have seen a strong recovery in February and March of this year for Cairo, with RevPARs doubling. Overall RevPAR increase in Q1, however, was limited to 4.9% as the Egyptian uprising had not started yet in January 2011.

Amidst the gloom ...

- 2011 was a year of strong recovery for Greek tourism, with a record 16.4 mn visitors (up by 9.5% from 15.0 mn in 2010), bringing in a revenue of € 10.5 bn in 2011 (up by 9.5% from € 9.6 bn in 2010). The Russian market achieved the best results with 739 th. visitors (+63.8%) spending € 743 mn (+49.8%), followed by France with +32.4% in visitors and +30.9% in receipts. Germany remained the biggest source market with 2.2 mn visitors (+9.9%) spending €1.8 bn (+13.2%).

- Expectations for 2012 are not very optimistic so far, with a disappointing level of bookings from especially- the northern European markets due to a mix of economic decline, public opinion on Greece, strikes and renewed competition from Mediterranean destinations including Egypt and Tunisia. According to the Bank of Greece, the first two months of 2012 showed a drop of 11.1% in terms of visitors and 44.7% in receipts. Of course, the main season has not started yet and many have hopes for another increase of Russians coming to Greece and a surge in late bookings from Northern and Western Europe – a number of German and Austrian tour operators have already run campaigns to reverse the image of Greece and increase bookings for Greek hotels and resorts.

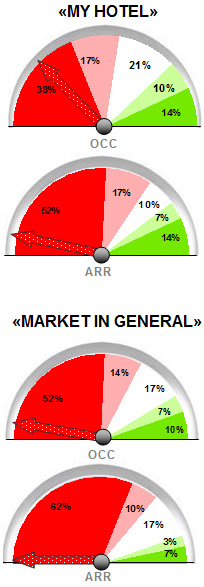

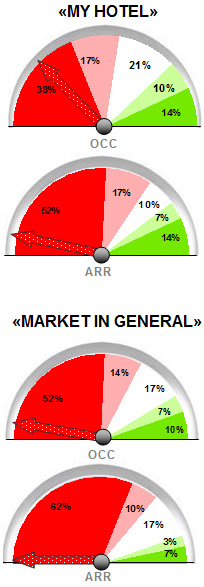

- This pessimism is also reflected in our Tourism Barometer survey for 2012 Q2. Hoteliers expect for 2012 as a whole falling occupancy levels and room rates for their own hotel as well as for the market in general.

- Greece is currently going through its fifth year of recession and elections will take place on May 6. The outcome of these elections is highly uncertain as the crisis has led to the demise of the 2 major parties (PASOK and ND) and a rise of populist parties, with voters angry at unemployment and austerity casting protest votes. It is unlikely that there will be a clear winner and therefore markets are closely following the events. It is even uncertain whether the two main parties that have backed the coalition government of former Central Banker Lucas Papademos and voted in favour of the bailout program will secure a majority of the 300 seats available. Possibly they need support from a nonmainstream party.

... structural changes are taking place

- In spite of angry voters, public unrest and a deteriorating image of Greece abroad, the country has achieved much in the past two years: Greece, according to the OECD, has implemented the fastest fiscal consolidation ever; it also ranks as the 2nd fastest changing economy according to Euro Plus Monitor. For more details see presentation in www.greeceischanging.gr.

- Concrete measures are being taken to support tourism as a catalyst for economic development. The Association of Greek Tourism Enterprises (SETE) and the State have agreed to set up Marketing Greece SA as a PPP with the sole purpose of promoting Greek tourism. Marketing Greece will manage a budget of € ~6 mn a year, of which around € 4 mn will be sourced from the private sector.

- The tender for the development of the Athens International Conference Centre is moving ahead, as a consortium made up of the owners of major 5* hotels in Athens and Greece's leading international airline has been shortlisted for the next phase.

- Two major privatisations seem to be on track with 9 expressions of interest from 7 countries for the redevelopment of Athens former airport 620 hectare site (Hellinikon) and 17 expressions of interest from 12 countries for the privatisation of the Public Gas Company (ΔΕΠΑ) and the Gas Transportation Company (ΔΕΣΦΑ). Interested investors come from the Middle East, Europe, Russia and ex-CIS countries, Asia and the Americas.

- The National Bank of Greece, owner of the coveted Astir Palace resort, www.astir-palace.com, announced its intention to sell it off. The Astir Palace in Vouliagmeni, an upmarket Athens suburb, consists of 3 hotels (a Westin, a Luxury Collection and a planned W) on a private peninsula of 30 hectares.

- Finally, a member of the royal family of Qatar is reported to have bought, for under € 5 mn., the Oxia island in the Ionian sea. The Oxia island has an area of 1,236 acre.

Endnotes

1 The international arrivals statistics are based on SETE calculations compiling the data from 13 major airports of Greece, representing 95% of foreigners' arrivals by plane in Greece and 72% of total foreigners' arrivals. Thessaloniki airport does not distinguish between arrivals of Greeks and foreigners.

2 RevPAR : Revenue per Available Room; for Greek resorts, calculations are based on TRevPAR (i.e. Total RevPAR).

Download this issue as:

- PDF (404 kb)

Back to newsletter