Greek Hospitality Industry Performance - 2nd Quarter 2012

Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

% Change in International arrivals1 in Greek airports, 2012 compared to 2011

Region |

% Change Q2 |

% Change YTD Q2 |

| Athens |

-15.1% |

-14.9% |

| Thessaloniki |

6.6% |

7.0% |

| Rest of Greece |

-1.8% |

-1.8% |

Source: SETE, processed by GBR Consulting

% Change in RevPAR2 in Greek hotels, 2012 compared to 2011

Region |

% Change Q2 |

% Change YTD Q2 |

| Athens |

-28.4% |

-23.4% |

| Thessaloniki |

16.6% |

14.8% |

| Resort |

-4.1% |

-4.5% |

Source: GBR Consulting

RevPAR in Competitive Destinations, 2012 compared to 2011

Region |

% Change Q2 |

% Change YTD Q2 |

| S. Europe |

1.6% |

1.1% |

| Rome |

-2.4% |

-0.7% |

| Madrid |

-3.6% |

-3.6% |

| Cairo |

36.6% |

16.7% |

Source: STR Global, processed by GBR Consulting

Commentary

-

Greece has left a difficult second quarter behind with a first round of elections on May 6th 2012 and a second round on June 17th 2012, after which a coalition government was formed headed by Mr. Antonis Samaras, leader of the New Democracy party.

-

Mainly due to the continuing political and economic uncertainty around Greece in the second quarter, international arrivals declined 4.6% overall comparing the first six months of 2012 and 2011. Athens showed the biggest drop of all international airports in Greece of 15.1%, while Thessaloniki saw their international arrivals increasing with 7.0%.

-

As a result the RevPAR of Athenian hotels saw a significant drop of 28.4% in the second quarter, while Thessaloniki hoteliers saw their RevPAR increasing with 16.6%. The resort hotels did not have a good start of their season with a drop of 4.1% in terms of RevPAR comparing Q2 of 2012 with 2011.

-

The hotel sector in Cairo is recovering slowly with increases in their RevPAR this Q2. However, one should note that in the second quarter of 2011 former president Mubarak was detained after he stepped down in February 2011. The cities of Madrid and Rome saw their revenues per available room decline in Q2 2012 compared to same quarter in 2011.

Uncertainty in Q2 …

- The major uncertainties that emerged during the prolonged election period and their continuation owing to the as yet unknown outcome of negotiations with representatives of the countries creditors are the main two reason for the worsening of the country's economic outlook. According to IOBE (the Foundation for Economic and Industrial Research), whose director has become Greece's new finance minister, expects that the economy will contract another 6.9% this year taking the budget deficit to 9% of GDP, while unemployment is expected to soar to 23.6%.

- Data of the Bank of Greece reveals that travel spending by non residents fell 12.5% year-on-year May, reflecting also a decrease in non-residents' arrivals at an average year-on-year May rate of 10.8%. Travel receipts in the period of January – May 2012 were Euro 211 mn less compared to the same period last year reaching Euro 1,482.4 mn YTD May. Over the same period Greece received 336,600 less travelers, reaching a level at the end of May YTD of 2,784,100 travelers. Almost 10% more British traveled to Greece though in these first 5 months, but spent less than other years. The number of Germans declined with nearly 10% and also the number of Russians dropped with more than 21%.

…but hope for the remaining of the year

- Immediately after the June elections and the formation of a new Government, bookings to Greece were on the rise as the headlines on Greece in the press disappeared. According to market sources most traditional source markets of Greece picked up, but booking numbers remain well below those of the previous year.

- Furthermore, the Pan-Hellenic Federation of Hoteliers and the hotel employee union (POEE-YTE) signed mid July a new collective labor contract following 5 months of negotiations and several days of strikes. With this agreement, as per 31/12/2013, the basic salary will be cut by 15% while retaining all benefits for the staff. The contract is a very positive development for the currently troubled hotel sector.

- In the meantime the Government is working quietly on a fiscal adjustment plan including additional measures of Euro 11.5 bn in budget savings for 2013 and 2014. Talks on the savings are currently taking place. At the same time the Government has to open up (liberalise) markets for goods, services, professions and labor, eliminate barriers to private investment, privatise state property, combat tax evasion, cut wasteful public expenditure and use EU structural funds to boost public & private investments. Once is clear what Greece will do and how much support it gets, the discussion of Greece leaving the Euro zone should end.

Barometer

- As reflected our Tourism Barometer survey for 2012 Q3, hoteliers are also pessimistic for the third quarter of this year, after a difficult first half. As a result hoteliers are expecting to close the year of 2012 with a significant drop in both occupancy and room rates.

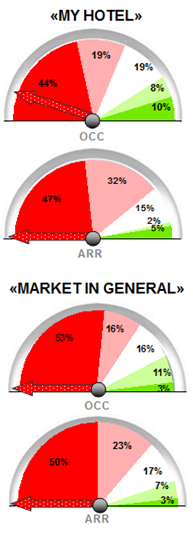

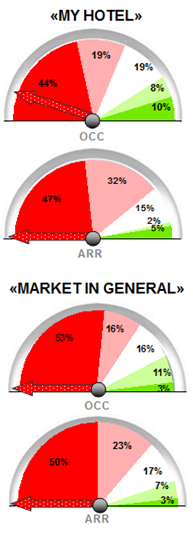

- The city hotel sector is clearly pessimistic for coming quarter as shown in the diagram below. Very few hoteliers expect improvements in occupancy levels and room rates. The majority predicts a drop in occupancy and ARR for their own properties, but also for the market overall.

City hotels

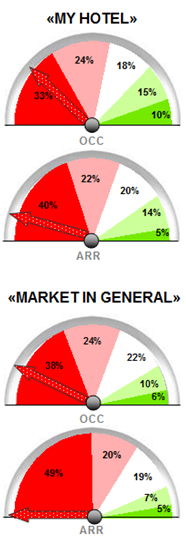

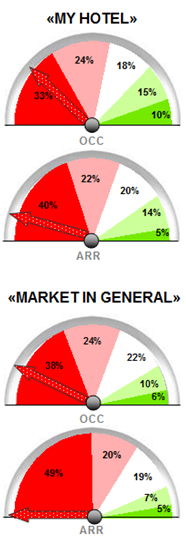

- Resort hoteliers predict that for Q3 the occupancy and room rates will decline in comparison with Q3 last year. A majority expects declines of more than 2% for their own properties. For the market in general they are even more pessimistic.

Resort hotels

Endnotes

1 The international arrivals statistics are based on SETE calculations compiling the data from 13 major airports of Greece, representing 95% of foreigners' arrivals by plane in Greece and 72% of total foreigners' arrivals. Thessaloniki airport does not distinguish between arrivals of Greeks and foreigners.

2 RevPAR : Revenue per Available Room; for Greek resorts, calculations are based on TRevPAR (i.e. Total RevPAR).

Download this issue as:

- PDF (421 kb)

Back to newsletter