Greek Hospitality Industry Performance - 3rd Quarter 2013

Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

% Change in International arrivals1 in Greek airports, 2013 compared to 2012

Region |

% Change Q3 |

% Change YTD Q3 |

| Athens |

1.4% |

0.1% |

| Thessaloniki |

3.1% |

2.3% |

| Rest of Greece |

13.6% |

14.5% |

Source: SETE, processed by GBR Consulting

% Change in RevPAR2 in Greek hotels, 2013 compared to 2012

Region |

% Change Q3 |

% Change YTD Q3 |

| Athens |

16.8% |

10.6% |

| Thessaloniki |

5.7% |

-11.0% |

| Resort |

14.5% |

15.6% |

Source: GBR Consulting

RevPAR in Competitive Destinations, 2013 compared to 2012

Region |

% Change Q3 |

% Change YTD Q3 |

| S. Europe |

5.3% |

4.3% |

| Rome |

-1.3% |

1.5% |

| Madrid |

-8.7% |

-6.8% |

| Cairo |

-58.9% |

-19.2% |

Source: STR Global, processed by GBR Consulting

Commentary

- 11.4 million tourists arrived at Greek airports in the first 3 quarters of 2013, representing an increase of more than 10% compared to last year. This result has been achieved primarily due to the performance of resort destinations, as tourist arrivals increased only marginally in Athens and Thessaloniki.

- Athens, in particular, has not benefited from the overall positive climate in the Greek tourism industry, mainly due to the negative image created over the past years. Nevertheless, it seems that the drop in Athens tourism bottomed out in 2012, as the recovery from 2013 Q2 onwards was reflected in an annual increase of the RevPAR by 10.6% YTD Sept. Further, according to Review Pro, Athens is rated in social media reviews as second only to Dublin in Europe with 81.3% vs 81.6% and compares very well with Cape Town which tops the list worldwide with 86%.

- Thessaloniki hotels saw a drop of 11% of their RevPAR in the same period, mainly as the health recovery program of the victims of the Libyan Civil War ended. Based on YTD August data of the Thessaloniki Hotel Association, overnight stays from Libyans dropped from 140,900 in 2012 to 13,253 in 2013. On the other hand, Thessaloniki saw substantial increases in arrivals from Russia (now the main foreign source market), Turkey, Israel, Romania and Serbia & Montenegro. As a result Q3 was substantially better than Q2 with a RevPAR change of +5.7% versus -18% in Q2.

- Resort hotels' RevPAR continued its rise, at +15.6% YTD Sept. compared to same period last year.

Greek Tourism continues its positive track

- Official figures of the Bank of Greece up to August 2013 show that € 8.7 billion was generated from tourism, an increase of € 1.05 billion or 13.7% compared to same period last year. 928,300 Russians alone brought in € 975 million, compared to € 532 million in 2011 by 516,600 Russians. In total the BoG recorded 12.6 million arrivals up to August 2013, a rise of 14.7% compared to last year.

- SETE (Association of Greek Tourism Enterprises) estimates that total revenue for 2013 will reach € 11.6 billion, same as record year 2008. Arrivals are expected to peak at 17.5 million by the end of 2013.

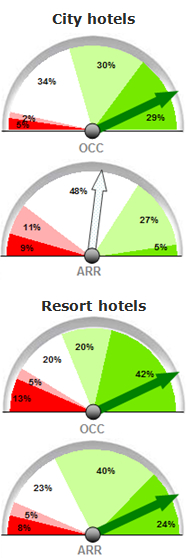

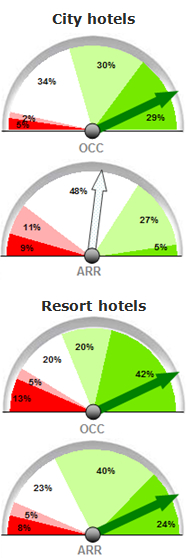

- Hoteliers are indeed optimistic for the last quarter of this year, according to the GBR Consulting barometer for 2013 Q4. Resort hoteliers maintain the bullish attitude they showed throughout the year. All barometers are deeply green coloured, indicating that they expect significant increases in both occupancy levels and room rates for Q4 compared to same quarter last year.

- City hoteliers are equally optimistic for their occupancy levels, while they forecast for Q4 similar ARR levels as the same quarter last year, both for their own hotels as well as for the market in general.

Expectations for Q4 2013

Strategic plan for the development of tourism and other developments

- During its Annual Conference, SETE presented the "Strategic Tourism Plan 2021" developed by McKinsey. The study, which has not been released in full, forecasts that tourism will be the driving force behind the Greek economy for at least the next 8 – 10 years. The tourism strategy has been built around 6 main tourism products: Sea & Sun, MICE Tourism, City Breaks, Cultural Tourism, Maritime Tourism and Medical Tourism. For each pillar a specific strategy is being developed including target markets, client segmentation, infrastructure development and marketing.

- The target is for 22 – 24 million arrivals by the year 2021 with a higher average spend than today. This will lead to an estimated contribution to the Greek GDP of € 41 – 44 billion, representing an increase of € 16 – 17 billion, and a total employment of around 1 million, an increase of 300,000. In order to achieve this result, 3.3 billion Euro needs to be invested annually throughout the period 2014 – 2020.

- TUI has announced that it is set to bring an additional 300,000 tourists to Greece in 2014, raising its total to 2 million. As a result of its focus in Greece, it has also announced that it intends to build two hotel units on Rhodes and Crete.

- A further notable development is that the EU has finally approved the acquisition of Olympic Airlines by Aegean Airlines, permitting the development of a viable national carrier. Already, Aegean has announced ~50 new international routes and expansion of the cooperation of Olympic with Etihad to enrich links of Athens with Asia, via Abu Dhabi.

6% of hotels are branded and 21% of the hotel rooms

- According to a newly released report of GBR Consulting on Hotel Brands in Greece, 6% of all hotels carry an international, national or local brand or is a member of a marketing consortium, while 21% of all hotel rooms in Greece are similarly branded.

- TUI, with 9,211 rooms, and Thomson, with 2,956 rooms, are among the top 3 brands, clearly reflecting the way Greek tourism developed in the last decades with an overreliance on the Sea & Sun product and a hand-in-hand dependence on tour operators. The top-3 is completed by Mitsis Hotels in second position with 5,334 rooms. The first international brand with no Sea & Sun focus is Starwood Hotels & Resorts Worldwide on 7th position with 2,301 rooms.

- Analysis per category shows that:

- international brands are particularly strong in the 5* category;

- national brands are particularly strong in the 4* category;

- local brands are particularly strong in the 3* and 2* categories;

- no international brand is represented in the 1* category..

Endnotes

1 The international arrivals statistics are based on SETE calculations compiling the data from 13 major airports of Greece, representing 95% of foreigners' arrivals by plane in Greece and 72% of total foreigners' arrivals. Thessaloniki airport does not distinguish between arrivals of Greeks and foreigners.

2 RevPAR : Revenue per Available Room; for Greek resorts, calculations are based on TRevPAR (i.e. Total RevPAR).

Download this issue as:

- PDF (399 kb)

Back to newsletter