Greek Hospitality Industry Performance - 4th Quarter 2013

Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

% Change in International arrivals1 in Greek airports, 2013 compared to 2012

Region |

% Change Q4 |

% Change YTD Q4 |

| Athens |

14.3% |

2.5% |

| Thessaloniki |

12.0% |

3.4% |

| Rest of Greece |

30.5% |

14.9% |

Source: SETE, processed by GBR Consulting

% Change in RevPAR2 in Greek hotels, 2013 compared to 2012

Region |

% Change Q4 |

% Change YTD Q4 |

| Athens |

13.9% |

11.2% |

| Thessaloniki |

10.7% |

-5.9% |

| Resort |

28.4% |

16.3% |

Source: GBR Consulting

RevPAR in Competitive Destinations, 2013 compared to 2012

Region |

% Change Q4 |

% Change YTD Q4 |

| S. Europe |

6.2% |

6.0% |

| Rome |

-0.4% |

1.5% |

| Madrid |

-10.6% |

-7.8% |

| Cairo |

-42.3% |

-25.5% |

Source: STR Global, processed by GBR Consulting

Commentary

- In 2013 12.6 mn tourists arrived at the main Greek airports representing an increase of 10.8% in comparison to 2012. According to estimates of SETE, the total number of tourists in Greece reached 17.8 mn, up 15% from 2012 also thanks to a significant rise in arrivals by road. With respect to revenue, SETE forecasts 11.5 bn euro over 2013 (+15%), while that number rises to 12.2 bn euro when cruise passengers are also taken into account.

- Official data of the Hellenic Statistical Authority until September 2013 showed an increase of 15.2% in tourist arrivals compared to same period last year in line with the above forecast of SETE for 2013 as a whole. Tourists from China grew by a spectacular 85% year-on-year, while Russia and Turkey showed increases of 49% and 45% respectively. From the major source countries, France and Italy showed increases of 17% and 14% respectively.

- Athens airport saw a small recovery (+2.5%) in international tourist arrivals, after 6 years of decline. Further levels at Athens' hotels bottomed out primarily due to a recovery in leisure tourism and from April onwards occupancy improved significantly yoy, while room rates remained at 2012 levels. Similarly, Thessaloniki recorded significant increases in RevPAR as from August 2013, after 7 months of decline; as a consequence, the drop in RevPAR was contained at -5.9% for 2013 as a whole. The resort hotels had a good year with a 16.3% increase in RevPAR in 2013 compared to 2012.

- By comparison, Rome remained stable in Q4 and ended 2013 with a +1.5% in RevPAR. Madrid and Cairo further deteriorated with significant drops in Q4, so that the year was closed with drops in RevPAR of -7.8% and -25.5% respectively.

Confidence in the Greek economy returning

- Even though the economy retracted by an estimated 3.5% in 2013 and unemployment is still at record levels, confidence is slowly returning. Towards the end of 2014 a pick-up of the economy is expected after seven recessionary.

- The ACEO/ICAP 2013 Q4 CEO survey among 2,340 Greek CEOs, indicated that 50% overall -and 65% among the CEOs of the very big companies - expects that the Greek economy will improve in 2014.

Very high tourist satisfaction rates in Athens and Thessaloniki

- Based on the latest Tourist Satisfaction surveys conducted by GBR Consulting on behalf of the Athens and Thessaloniki Hotel Associations, tourists are very satisfied with their experience. In Athens, contrary to perceptions, throughout the period 2009 – 2013 more than 90% of visitors surveyed would come for a return visit and / or recommend Athens to family and friends. Furthermore, 93% of the respondents of the 2013 survey considered their experience in Athens as expected or better.

- In Thessaloniki the tourist satisfaction survey showed that a stunning 93% of the leisure tourists would recommend Thessaloniki to other people and that the overall assessment mark was 8.0 on a scale of 1 – 10, where culture, the locals' behaviour and leisure & entertainment were the highest rated.

Hotel transactions

- In December the Hellenic Republic Asset Development Fund announced that ~90% of the shares of the Astir Palace Resort was sold for € 400 mn (corresponding to an Enterprise value of just under € ½ bn) to Saudi Arabian fund ACG, which is allied with the Turkish Dogus Group and four other Arab funds. The resort complex consists of the 123 room Arion Resort & Spa, the 162 room Westin hotel, the non operational 165 room Aphrodite hotel –planned to be developed as a W hotel- as well as the right to use the two beaches, marina concession rights and the allowance to demolish some existing buildings to build residential units. It is understood that the new owners will create a multiple resort with very high-end villas and ultra-luxurious hotels.

- The 405-key Grand Hotel in Rhodes was sold by the National Bank of Greece to Mitsis Group of Hotels for an amount of 38 mn euro according to press reports. The hotel, which will be renovated, had been on lease to the Mitsis Group, but the lease ended.

- Finally, it is reported that Eurobank will again try to sell the 694-key Capsis hotel in Rhodes as an earlier deal with a German firm was called off. Also National Bank owned Gerakina beach in Chalkidiki with 500 rooms failed to sell at around 15 – 17 mn, but renewed attempts are being undertaken.

Outlook 2014

- SETE has announced that for 2014 the Greek tourism industry is aiming at 18 mn international tourist arrivals and € 13 bn revenue. Bookings of tourism packages so far seem to confirm these expectations as Germany, Britain and Russia are 10% above those recorded at the same time last year according to the Hellenic Hotel Federation.

- The Association of British Travel Agents (ABTA) has included Greece among the 12 popular and emerging destinations that British tourists are recommended to look at for their holiday in 2014. Online travel agency Expedia announced that searches for Greek island holidays have more than doubled for 2014 compared to 2013. Search in October and November for Greece grew 128% from a year earlier, the biggest rise among all destinations, with Morocco in second position (+119%).

- For Athens it is expected that leisure tourism will further recover as data shows that the city is a very attractive city break destination with very high satisfaction ratings. Also the announcement that Ryanair will create a new hub in Athens connecting it to, inter alia, London, Milan and Paphos in Cyprus, will further contribute to the attractiveness of Athens. With the expected return of the conference and incentive market to Athens, as well as the further expansion of the Piraeus cruise terminal, Athens will be back on a track of growth.

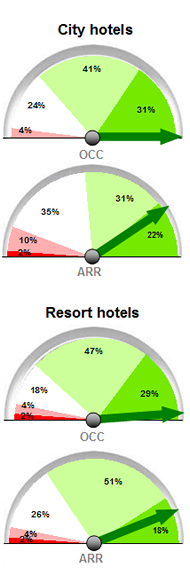

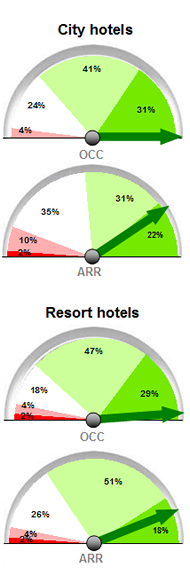

- Finally, according to the according to the GBR Consulting barometer for 2014 Q1 the hotel sector expects to achieve significant improvements in both occupancy and room rates. The 5* and 4* segments are expecting to achieve higher occupancies and ARRs, while the 3* sector is more cautious with improving occupancy levels and similar room rates as last year.

Expectations for 2014

Endnotes

1 The international arrivals statistics are based on SETE calculations compiling the data from 13 major airports of Greece, representing 95% of foreigners' arrivals by plane in Greece and 72% of total foreigners' arrivals. Thessaloniki airport does not distinguish between arrivals of Greeks and foreigners.

2 RevPAR : Revenue per Available Room; for Greek resorts, calculations are based on TRevPAR (i.e. Total RevPAR).

Download this issue as:

- PDF (391 kb)

Back to newsletter