Greek Hospitality Industry Performance - 3rd Quarter 2014

Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

% Change in International arrivals1 in Greek airports, 2014 compared to 2013

Region |

% Change Q3 |

% Change YTD Q3 |

| Athens |

23.5% |

28.3% |

| Thessaloniki |

16.7% |

15.4% |

| Rest of Greece |

10.4% |

10.5% |

Source: SETE, processed by GBR Consulting

% Change in RevPAR2 in Greek hotels, 2014 compared to 2013

Region |

% Change Q3 |

% Change YTD Q3 |

| Athens |

24.9% |

26.2% |

| Thessaloniki |

19.0% |

14.5% |

| Resort |

5.1% |

5.7% |

Source: GBR Consulting

RevPAR in Competitive Destinations, 2014 compared to 2013

Region |

% Change Q3 |

% Change YTD Q3 |

| S. Europe |

7.4% |

6.4% |

| Rome |

4.1% |

3.8% |

| Madrid |

29.1% |

9.1% |

| Cairo |

|

13.1% |

Source: STR Global, processed by GBR Consulting

Commentary

- International tourist arrivals at the main airports of Greece increased by 1.6 mn up to September 2014, representing an increase of 14.3%. The main contributor is Athens, as the city received 600,000 international tourists more than last year up to September; an increase of 28.3% and thus recovering –in terms of arrivals- in one year a decline of 5 years. The Athens Hotel Association, the Athens International Airport, Aegean Airlines and Marketing Greece are working together to further improve the city's performance. According to data of GBR Consulting the overall assessment by tourists increased steadily from a mark of 7.3 in 2009 to 7.8 out of 10 throughout the years of 2012 – 2014. Also according to provisional data of GBR Consulting of the satisfaction survey of 2014, more than 96% of the tourists would recommend Athens to family and friends. Lastly, Athens hosted in October over 800 travel bloggers and writers as part of the TBEX Europe 2014 conference, which further boosted the city as an attractive destination.

- As a result occupancy levels significantly improved and reached 2008 levels. However, room rates showed a mild increase only and are still on average 16% below the levels of 2008.

- Thessaloniki welcomed 172,000 (+15.4%) more tourists and therefore hotel occupancy levels improved by 14.7% up to September 2014 compared to same period last year, while room rates remained stable. According to data of the Thessaloniki Hotel Association, the Greeks returned to Thessaloniki (+14.7%) and are by far the main source market in terms of overnight stays, followed by visitors from Cyprus, Turkey and Russia, which shows a decline this year. Visitors from Poland, Belgium and The Netherlands had the biggest increase so far this year in overnight stays with +125%, +96% and 93% respectively.

- The Total Sales per Available Room for the resort hotels in Greece improved with 5.1% as a result of increasing revenue.

- Finally, Rome saw its RevPAR improve in Q3 with 4.1%, while Madrid had a very strong Q3 with an increase of +29.1% in RevPAR in Q3. Cairo also recovered strongly this quarter, noting that in the same quarter last year the hotel sector in Cairo collapsed as a result of the start of protests and clashes in the streets of Cairo.

Positive effect on the Greek economy

- The Greek economy benefits from the good results of the tourism sector. Strong tourism receipts are driving Greece's current account. Up to August, € 9.7 bn of tourism receipts were recorded by the Bank of Greece, an increase of 11.1% compared to the same period in 2013 and 27.3% compared to 2012.

- As a result the Association of Hellenic Tourism Enterprises (SETE) estimates that tourism's direct and indirect contribution to Greece's GDP has risen considerably and will exceed 20%, from just over 16% previously. According to data of the Hellenic Statistical Authority the only economic sector to show an increase in employment was services, thanks to tourism, amounting to 1.2%.

- Finally, a survey of the Bank of Greece showed that foreigners doubled their investment in Greek property, mostly holiday homes in H1 of 2014 compared to H1 2013. The foreign interest in the local market is fuelled by the drop in prices, significant increases in tourism arrivals and to government measures that have made transactions more attractive, such as a reduction in transfer tax and the offering of a residence permit to non-European buyers for transactions above € 250,000.

Outlook 2015

- According to Alpha Bank the international tourism arrivals could reach 20 mn this year (excluding 2.5 mn for cruises) compared to 17.9 mn in 2013. For 2015 further growth is forecasted. Leading European tour operator TUI has announced that the company will bring some 2.2 mn tourists to Greece next year, which will be an increase of 10%. Also the British travel agencies already witnessed increased interest in Greece for next year. According to market sources Greek hoteliers have negotiated a 3% – 4% rate increase in contracts signed with foreign tour operators for 2015.

- Further investments in tourism infrastructure are needed though. The Hellenic Republic Asset Development Fund announced in October that they received three binding bids for the exploitation of two clusters of 7 regional airports each. The consortia that submitted bids for both clusters are Corporation Amercia SA with Metka SA, Fraport AG with Slentel Ltd and Vinci Airports SA with Aktor Concessions SA. The award decision is expected within November.

New hotel developments announced this quarter - highlights

- This quarter it was reported that the former Gerakina Beach hotel in Chalkidiki is currently being renovated for € 10 mn to become the second all inclusive resort hotel of the Ikos Resorts chain, an investment of the American fund Oaktree and Sani SA. The new name of the 300-room resort will be Ikos Olivia and it will operate in the summer season of 2015.

- Furthermore, in the prefecture of Corinth in the Peloponnese, € 38 mn will be invested to develop a 121-room 5 star resort under the name Nisi Mareza on a private peninsula of 73 ha. Also in the Peloponnese, Dolphin Capital announced in August that they agreed with Colony Capital on an investment of € 40.4 million into Amanzoe, a luxury resort hotel and villa complex near Porto Heli.

- In Platania - Chania, Crete a € 41 mn investment was announced for the development of a 285-room 5 star hotel. On the Cycladic island of Ios a 249-beds hotel of the 5 star category is going to be constructed for a total of around € 20 mn. Furthermore, the development of a new marina on the island was announced with a capacity of 175 berths. On the island of Mykonos two small 5 star units are planned in the area of Koundouros and one 4 star hotel in Agios Stefanos. In Lindos, Rhodes a new 4 star unit of 348 beds is planned with a total budget of € 15.2 mn. In addition two developments of 84 and 14 beds are also in the pipeline on the island. On the Ionian island of Zakynthos various new units are planned of among two 5-star units of 84 and 68 rooms as well as two new 4 star hotels of a capacity of 117 and 99 beds.

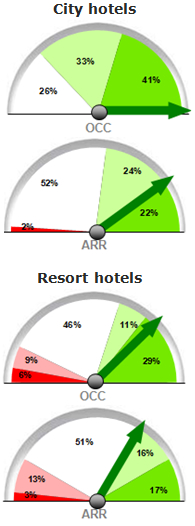

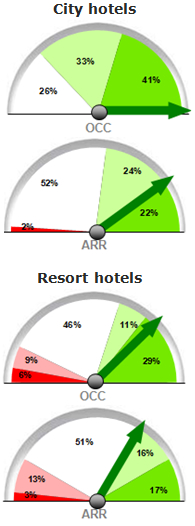

Barometer

- According to the GBR Consulting barometer for 2014 Q4 city hoteliers continue to be very optimistic, also for Q4. The resort hotels that are in operation this Q4 are optimistic, but slightly more cautious.

Expectations for Q4 2014

Endnotes

1 The international arrivals statistics are based on SETE calculations compiling the data from 13 major airports of Greece, representing 95% of foreigners' arrivals by plane in Greece and 72% of total foreigners' arrivals. Thessaloniki airport does not distinguish between arrivals of Greeks and foreigners.

2 RevPAR : Revenue per Available Room; for Greek resorts, calculations are based on TRevPAR (i.e. Total RevPAR).

Download this issue as:

- PDF (395 kb)

Back to newsletter