Greek Hospitality Industry Performance - 1st Quarter 2015

Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

% Change in International arrivals1 in Greek airports, 2015 compared to 2014

Region |

% Change Q1 |

% Change YTD Q1 |

| Athens |

29.5% |

29.5% |

| Thessaloniki |

22.3% |

22.3% |

| Rest of Greece |

104.3% |

104.3% |

Source: SETE, processed by GBR Consulting

% Change in RevPAR2 in Greek hotels, 2015 compared to 2014

Region |

% Change Q1 |

% Change YTD Q1 |

| Athens |

17.3% |

17.3% |

| Thessaloniki |

7.6% |

7.6% |

| Resort |

0.4% |

0.4% |

Source: GBR Consulting

RevPAR in Competitive Destinations, 2015 compared to 2014

Region |

% Change Q1 |

% Change YTD Q1 |

| S. Europe |

9.3% |

9.3% |

| Rome |

-2.0% |

-2.0% |

| Madrid |

11.8% |

11.8% |

| Cairo |

87.3% |

87.3% |

Source: STR Global, processed by GBR Consulting

Commentary

- International Tourist Arrivals at the airports of Athens and Thessaloniki increased significantly with 30% and 22% respectively in 2015 Q1 compared to the same quarter last year. As a result performance of the hotel sectors of both cities improved further (RevPAR increased by 17.3% and 7.6% respectively), especially in terms of occupancy, while room rates increased mildly.

- In the rest of Greece the resort locations of Chania and Heraklion in Crete, Corfu and Kos received together nearly 13,000 more international tourist arrivals at their airports than Q1 last year. However, the RevPAR of resort hotel overall in Q1 remained on par with 0.4%.

- On an international level Madrid had a good performance in Q1 mainly due to strong improvements in room rates, while Rome saw a decline in their ADR yoy. Cairo is clearly on its way back with an improvement of their RevPAR of 87% yoy.

Very high tourist satisfaction in Athens and Thessaloniki

- 2014 was an excellent year for Athens, receiving an estimated of 550,000 overnight stays more than 2013, translating in € 171 mn revenue for the city of Athens, of which € 90 mn covers retail only (shops, restaurants and bars), according to a survey conducted by GBR Consulting on behalf of the Athens Hotel Association. Tourists are very satisfied with their experience in Athens with an overall assessment mark of 7.8. Especially the Athenian culture and behaviour of its residents are highly appreciated and a staggering 96% of the tourists would recommend Athens to their friends and relatives. This, together with the high marks for the Athenian hotel infrastructure is a firm basis for further improvements of the Athenian hotel sector especially in terms of room rates, also considering the levels of major European competitors.

- In March the Tourist Satisfaction Survey of Thessaloniki was presented, showing a very high appreciation of the city with an overall assessment mark of 8.0. The survey, conducted by GBR Consulting on behalf of the Thessaloniki Hotel Association, revealed that Thessaloniki’s entertainment, culture and its people are the city’s strongest assets. A stunning 91% of the tourists would recommend Thessaloniki to their friends and relatives. Compared to other European cities, Thessaloniki showed one of the lowest ARR and occupancy levels in 2014, which could be improved given the high tourist satisfaction levels observed. Almost all tourists had a better or much better experience in Thessaloniki than they had thought before their departure, meaning that the city really surprised their guests in a positive manner.

Investment highlights of 2015 Q1

- Two new 5 star resorts, Ikos Olivia and Blue Lagoon Princess both located in Chalkidiki within 6 km from each other, will open next month.

- Ikos Resorts, a JV between Oaktree Capital and Sani

SA, will open the 295 room Ikos Olivia (former

Gerakina Beach, fully redeveloped). Ikos Resorts are a

high-end all inclusive “Infinite Lifestyle” concept

covering wellness and gastronomy, overseen by

Michelin-starred chefs and also operates the 298 room

Ikos Oceania (former Oceania Club & Spa), which

underwent a full renovation. The company plans to be

operating 7 – 10 hotels across prime locations in

Greece and the Mediterranean within the next 4 – 5 years.

- The newly constructed 5 star Blue Lagoon Princess will

open its doors in May. The 250 room resort is located

on the beach of Kalives and offers swimming pools, 3

restaurants, 3 bars, spa and kids club. The new resort

will operate under the all-inclusive concept and is

owned by the company Eurotel of the Dourou family,

but will be operated under the Blue Lagoon Group,

which also operates 4 resorts in Kos and one in

Karpathos.

- In February it was reported that Leisure Holding SA, the owners of the 5-star 326 room Amathus Beach Hotel accepted a binding offer from private equity firm Invel Real Estate of € 30 mn (€ 92,000 per room, showing the recovery of the resort hotels sector).

Current economic instability could influence tourism this year

- In Q4 2014 the Greek economy declined 0.4% yoy, bringing to an end three consecutive quarters of recovery during which the economy grew by 1.7%. On the other hand industrial production posted a solid increase in January and February and is currently up 1.9% yoy. Oxford Economics therefore forecasts a modest economic expansion of 0.9% this year.

- Greece has not received for eight months any external financing, but concerns are increasing that the Government is running out of cash. It seems that the next tranche of financing will only be released after Greece has agreed to a detailed and fully-funded policy agenda with its international creditors. As a result the Government is investigating various ways to collect cash including tax increases in the tourism sector.

- The economic uncertainty is having a growing impact on tourism with bookings from Germany showing significant drops in February and March, while bookings up to December were showing significant increases. Bookings from the UK are still up, but estimates by SETE show that Greece’s share has dropped. Arrivals from Russia are expected to decline 20% – 30% this year, but this is caused by the devaluation of the Russian rubble making holidays in Greece much more expensive.

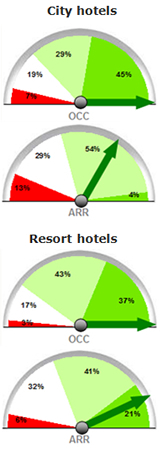

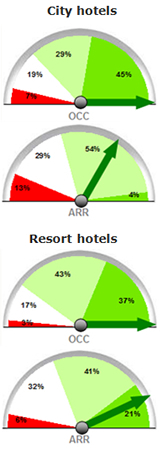

Barometer

- Regardless the economic uncertainty Greek hoteliers remain optimistic for 2015 according to the GBR Consulting barometer for 2015 Q2. City hoteliers are expecting to continue the positive trend of Q1 with significant increases in occupancy and room rates in 2015 compared to last year. Resort hoteliers, who are just opening, are much more cautious in their forecast with occupancy and ARR at a similar level as last year.

Expectations for 2015

Endnotes

1 The international arrivals statistics are based on SETE calculations compiling the data from 13 major airports of Greece, representing 95% of foreigners' arrivals by plane in Greece and 72% of total foreigners' arrivals. Thessaloniki airport does not distinguish between arrivals of Greeks and foreigners.

2 RevPAR : Revenue per Available Room; for Greek resorts, calculations are based on TRevPAR (i.e. Total RevPAR).

Download this issue as:

- PDF (490 kb)

Back to newsletter