Greek Hospitality Industry Performance - 2nd Quarter 2015

Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

% Change in International arrivals1 in Greek airports, 2015 compared to 2014

Region |

% Change Q2 |

% Change YTD Q2 |

| Athens |

24, 0 % |

25.9% |

| Thessaloniki |

-0.1% |

6.5% |

| Rest of Greece |

-0.5% |

-0.1% |

Source: SETE, processed by GBR Consulting

% Change in RevPAR2 in Greek hotels, 2015 compared to 2014

Region |

% Change Q2 |

% Change YTD Q2 |

| Athens |

7.6% |

9.5% |

| Thessaloniki |

12.3% |

10.3% |

| Resort |

1.3% |

0.4% |

Source: GBR Consulting

RevPAR in Competitive Destinations, 2015 compared to 2014

Region |

% Change Q2 |

% Change YTD Q2 |

| S. Europe |

11.7% |

10.4% |

| Rome |

3.8% |

2.3% |

| Madrid |

22.7% |

17.7% |

| Cairo |

|

72.7% |

Source: STR Global, processed by GBR Consulting

Commentary

- International Tourist Arrivals at the airport of Athens continued their upward trend with an increase of 24% over the second quarter of 2015, unaffected by Greece’s debt crisis. Americans are one of the market segments showing significant increases in arrivals. This is due to the strengthening of the Dollar as well as the fact that the US media have in general kept a mild attitude towards the crisis in Greece and travellers are therefore not much affected by negative news. Performance in Athenian hotels remains robust with an improvement of 7.6% in RevPAR during Q2 compared to same quarter last year.

- Arrivals in Thessaloniki during Q2 2015 are on par with last year, giving also some indication for the resort location of Chalkidiki, although tourists are arriving by car from neighbouring countries as well. The hotel sector in Thessaloniki significantly improved performance during the second quarter with a +12% in RevPAR.

- With respect to other resort locations, Crete saw a decrease of 2.8% in international airport arrivals this year up to June, while the Ionian Islands attracted 3.9% more arrivals. The airports of Mykonos & Santorini received 17.9% more international tourists YTD June, while the airport of Araxos and Kalamata in the Peloponnese attracted 25% more arrivals. Overall RevPAR performance at resort hotels is on par in H1 compared to the same period last year.

- On an international level Madrid continues its positive course during Q2, while Rome shows a small plus in RevPAR due to a very good month of June.

Agreement lifts risk of Grexit, but recession lies ahead

- On June 27th at the end of a four month extension to the 2nd bailout programme, the Greek prime minister announced that a referendum would take place on July 5th on a new bailout agreement. One day later the country had to impose capital controls. Despite that 61% voted against the proposed measures, Greece agreed at the Euro summit of July 12th to a list of prior actions as a precursor to negotiating a third adjustment programme of € 86 billion, of which € 25 billion should be raised through privatisation receipts. Negotiations are currently ongoing.The adjustment programme will require Greece to tighten fiscal policy by around € 4 billion or about 2.5% of GDP next year in order to hit the programme target of 2% of GDP primary surplus in 2016. These targets look challenging considering also the privatisation target and the weak political determination to implement the required agenda in full.

- With capital controls to remain in place through 2016, resulting in a continued lack of liquidity, the Greek economy is expected to decline by 1% this year and then fall a further 3.2% in 2016, according to estimates of Oxford Economics.

Late bookings were hit, but are recovering fast

- From the end of June until the Euro summit of the of July 12, the Greek tourism sector saw a significant drop in late bookings, particularly from Germany. However, as many trips had been booked long before and deposits are usually not refunded following a cancelation, the impact has been limited. Today with easing fears of capital controls as cash withdrawals do not affect foreign bank card holders, hotel bookings are recovering and tour operators and airlines mention that their reservations are showing renewed energy showing mild increases overall compared to last year. Turkey’s recent involvement in the war against IS and the terrorist attack in a beach hotel in Tunisia could also be of influence.

- To further restore the flow of bookings, the Greek National Tourism Organisation in cooperation with the Confederation of Greek Tourism and the support of regional authorities and tourism entities launched a campaign titled “Happening Now: #GreekSummer”. The campaign will run via Google for one month targeting the markets of Germany, Britain, France, Switzerland, Austria, The Netherlands and the Scandinavian countries.

- Domestic tourism on the other hand is suffering, mainly due to the imposition of capital controls, renewed uncertainty and increasing taxes. Destinations that depend on Greek tourists are hard hit.

Tax hikes impacting tourism sector

- The approval of the new round of measures by the Greek Government includes a number of measures affecting the tourism industry including VAT hikes. As from October 1st VAT for hotel accommodation will increase from 6.5% to 13%, which is the sixth highest rate for accommodation in the EU after Denmark, Slovakia, Britain, Hungary and the Czech Republic. The 30% reduced rate for the islands will be scrapped as of autumn, but there will be a new incentive scheme for certain islands categories.

- Food service VAT went up from 13% to 23%, now the fourth highest rate behind only Hungary (27%), Denmark (25%) and Romania (24%). Other VAT hikes to 23% include transport tickets and taxis.

- Finally, firms in the tourism sector are affected by the increase in advance tax payments and – to a lesser extent so far - by capital controls creating difficulties in international payments.

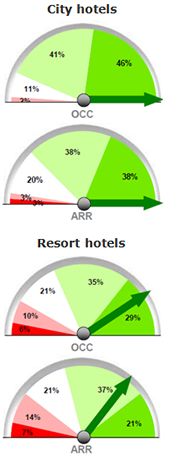

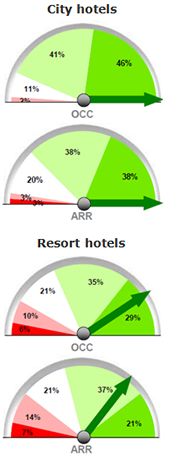

Barometer

- As a consequence of the above, optimism of hoteliers for another excellent tourism year has shrunk. The barometers for Q3 2015 show falling occupancy rates and stabilising room rates.

- However, city hotelier remain optimistic, especially in terms of room rate development as they forecast significant improvements this coming quarter compared to last year. Occupancy levels are expected to stabilise as only mild increases are forecasted for Q3. Resort hoteliers have become pessimistic. They forecast for Q3 significant drops in demand with dropping occupancy levels as a result.

Expectations for Q3 2015

Endnotes

1 The international arrivals statistics are based on SETE calculations compiling the data from 13 major airports of Greece, representing 95% of foreigners' arrivals by plane in Greece and 72% of total foreigners' arrivals. Thessaloniki airport does not distinguish between arrivals of Greeks and foreigners.

2 RevPAR : Revenue per Available Room; for Greek resorts, calculations are based on TRevPAR (i.e. Total RevPAR).

Download this issue as:

- PDF (395 kb)

Back to newsletter