Greek Hospitality Industry Performance - 4th Quarter 2010

Introduction

This newsletter provides a snapshot of the performance of Greek hotels based on a sample of more than 180 hotels & resorts in Greece. The hotel permorfmance data is complemented by data from other sources so as to place the Greek hospitality industry in the context of Greek tourism and of the International Hospitality Industry. Finally, the outlook of the industry, as seen by hoteliers themselves, is given.

% Change in International arrivals1 in Greek airports, 2010 compared to 2009

Region |

% Change Q1 |

% Change YTD Q4 |

| Athens |

0.5% |

-4.6% |

| Thessaloniki |

0.1% |

-3.5% |

| Rest of Greece |

-0.9% |

2.1% |

Source: SETE, processed by GBR Consulting

% Change in RevPAR2 in Greek hotels, 2010 compared to 2009

Region |

% Change Q1 |

% Change YTD Q4 |

| Athens |

-13.3% |

-7.4% |

| Thessaloniki |

-23.2% |

-20.0% |

| Resort |

3.6% |

0.2% |

Source: GBR Consulting

RevPAR in Competitive Destinations, 2010 compared to 2009

Region |

% Change Q1 |

% Change YTD Q4 |

| S. Europe |

9.7% |

6.6% |

| Rome |

10.4% |

7.9% |

| Madrid |

2.8% |

8.3% |

| Cairo |

12.2% |

7.6% |

Source: STR Global, processed by GBR Consulting

Commentary

- International arrivals by air showed an increase (+0.5%) for Athens this quarter, for the first time in 2010. This can be attributed to the 2500 years anniversary Marathon Run last October, which attracted a large number of foreign runners, and has helped to contain the overall drop to 4.6%. However the RevPAR developments continued to be negative, with Q4 showing the largest quarterly drop (-13.3%) of 2010, leading to an overall drop of 7.4% for the year. As a result of this performance, five downtown hotels in Athens have seized operations in the last 6 months.

- Thessaloniki showed a similar, if more marked, picture with a marginal increase (0.1%) in arrivals in Q4 and a sharp drop in the RevPAR of the quarter (-23.2%), leading to an annual RevPAR drop of 20%.

- This disappointing performance for city hotels is even more striking in comparison to competitive destinations and Southern Europe, which showed considerable improvements in their RevPAR in 2010.

- Resorts, however, performed better by holding their position on an annual basis (an annual increase in RevPAR of +0,2% and in arrivals of +2.1%); the feared collapse, in the wake of the adverse debt developments and associated publicity for the country, of the traditional Greek tourism product eventually did not materialise.

Hotel & Other News

- VAT on hotel services was reduced to 6.5% (effective Jan. 1st,, 2011) from 11%, in an effort to increase the competitiveness of the sector. According to our survey ‘Tourism Barometer’, www.gbrconsulting.gr/barometer, conducted among Greek hoteliers, 77% of hoteliers will use this reduction, either in its entirety (28%) or partially (49%), to boost competitiveness, while 10% remain indecisive and 13% will use it to increase their profitability.

Things to consider for the next Quarter

- The government has announced the start of the "Athens every week" marketing campaign in the aftermath of the successful staging of the Athens Marathon Run commemorating 2500 years from the original Marathon run. The 2500 Marathon Run attracted approximately 20,000 runners making a substantial impact to the occupancy of Athens hotels. The "Athens every week" campaign will create unique events for every week in Athens to increase its attractiveness as a destination. Furthermore, the two main parties have declared their intention to collaborate so as to preserve the centre of the town functional and avoid the social unrest of 2009 and 2010.

Outlook

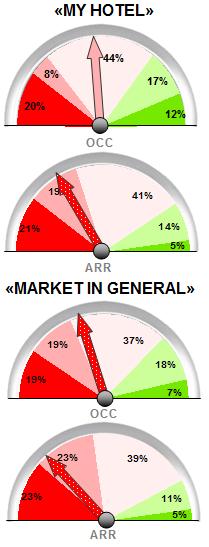

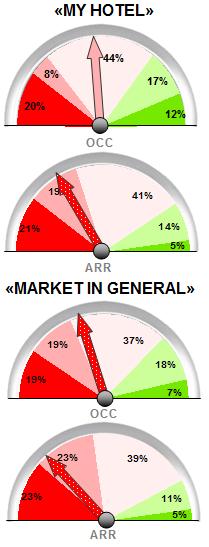

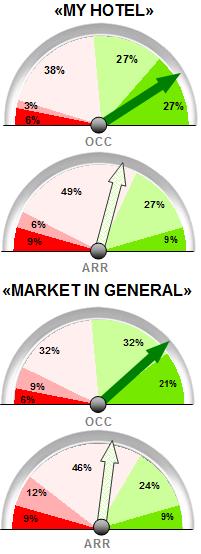

- In our Tourism Barometer survey (see above), hoteliers expect further deterioration in terms of Occupancy and ARR (see graph below). Pessimism is greater among city hoteliers than resort hoteliers.

>

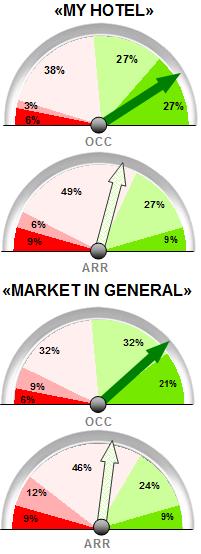

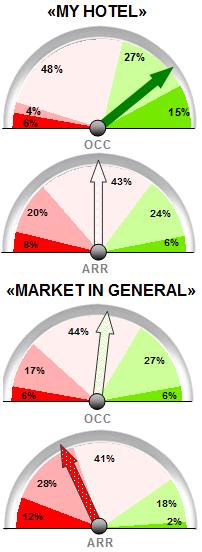

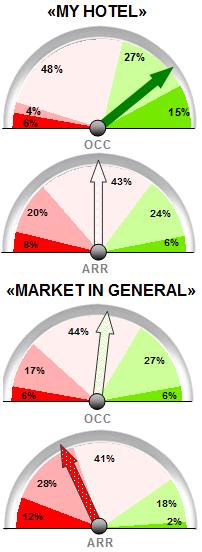

- The two segments that differ and show optimism in terms of Occupancy and ARR expectations, are the hoteliers of Crete and the hoteliers of 5* properties.

Hotels in Crete

5* Hotels

Endnotes

1 The international arrivals statistics are based on SETE calculations compiling the data from 13 major airports of Greece, representing 95% of foreigners' arrivals by plane in Greece and 72% of total foreigners' arrivals. Thessaloniki airport does not distinguish between arrivals of Greeks and foreigners.

2 RevPAR : Revenue per Available Room; for Greek resorts, calculations are based on TRevPAR (i.e. Total RevPAR).

Download this issue as:

- PDF (472 kb)

Back to newsletter