Greek Hospitality Industry Performance - 1st Quarter 2014

Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

% Change in International arrivals1 in Greek airports, 2014 compared to 2013

Region |

% Change Q1 |

% Change YTD Q1 |

| Athens |

32.3% |

32.3% |

| Thessaloniki |

11.5% |

11.5% |

| Rest of Greece |

-12.9% |

-12.9% |

Source: SETE, processed by GBR Consulting

% Change in RevPAR2 in Greek hotels, 2014 compared to 2013

Region |

% Change Q1 |

% Change YTD Q1 |

| Athens |

20.6% |

20.6% |

| Thessaloniki |

5.4% |

5.4% |

| Resort |

35.4% |

35.4% |

Source: GBR Consulting

RevPAR in Competitive Destinations, 2014 compared to 2013

Region |

% Change Q1 |

% Change YTD Q1 |

| S. Europe |

2.8% |

2.8% |

| Rome |

1.6% |

1.6% |

| Madrid |

2.6% |

2.6% |

| Cairo |

-21.4% |

-21.4% |

Source: STR Global, processed by GBR Consulting

Commentary

- The impact of the Greek crisis on the Athens tourism industry in the period 2010 to 2013 has been significant (full analysis here - pdf). GBR Consulting has estimated that the total loss in that period amounts to € 2.5 billion for the sector as a whole, of which € 820 million was for the Athens hotels. However, Athens tourism has been recovering since May 2013, as the negative headlines on Greece disappeared and a positive outlook started emerging. In the first quarter of 2014, we have seen significant increases in international tourist arrivals (+32%) as well as significant improvements in occupancy levels, albeit with stabilising room rates, which remain 21% lower than the corresponding quarter of 2008.

- With the leisure market solidifying, there are clear signs that the conference and incentive market is returning to Athens. Data from the Bank of Greece showed that the recovery of business tourism in Greece has commenced in 2013, with receipts of business travellers reaching € 634.4 million, up 8.9% compared to 2012, while the local Association of PCOs forecasts a sharp increase (+30%) in conferences. Business expenditure is, however, still at very low levels compared to the levels of between € 900 and 980 million in the pre-crisis years.

- The resort hotels that were operating though this first quarter showed strong improvements in RevPAR compared to the same quarter last year. In Thessaloniki occupancy improved in Q1 2014, while room rates showed a minor drop.

- Internationally, the Cairo hotel sector continues to suffer. Some tour operators mentioned that Greece and also Spain's Canary Islands were benefiting from the uncertain situation in Egypt.

Hope for the Greek economy...

- Oxford Economics states in their March 2014 report on Greece that prospects for the recovery of the Greek economy are certainly improving; Greece is now running both a primary fiscal surplus and current account surplus, which was unthinkable a few years ago.

- As a consequence, the yield on the 10-year Greek Government bonds dropped from an unsustainable 30% in 2011 to 6.3% today, which is a clear sign that investors are increasingly confident of the nation's ability to pay its debts, according to Bloomberg. In fact, on April 10th Greece returned to the bond market selling a 5 year bond of € 3 billion against a yield of 4.95%. The deal attracted more than € 20 billion of interest from over 550 investors, including € 1.3 billion from the banks which were managing the deal.

... supported by another good year of the tourism sector

- Official numbers of the Bank of Greece for the first two months of 2014 show that 10.4% more tourist arrivals have been recorded compared to the same period last year, partly due to record numbers of Russian arrivals (+154%). While in 2010 only 451,000 arrivals were recorded from Russia, in 2013 1,353,000 Russians came to Greece, while 1.5 million Russian are expected for this year. There are some concerns though, due to the unfolding crisis in the Ukraine, together with the devaluation of the ruble.

- Overall, SETE revised its forecast for this year and is now aiming at 18.5 – 19 million arrivals (up from 17.9 million in 2013 and Euro 13 billion in revenue, up from Euro 11.7 billion in 2013.

Transactions

- In January NCH Capital, a US private equity firm won the permission from the Greek government to build an upscale hotel with residential development on an unspoilt site near Kassiopi, North part of Corfu. This deal together with the expected entrance of Fairmont (2018) and Angsana's Byan Tree Resorts (2017) could boost the high end accommodation segment in Corfu, which is currently limited.

- In March it was announced that Oaktree Capital Group LLC set up a joint venture with Greek hotel owners and operators Sani SA to establish a new hotel brand, possibly under the name of "Oceania Club". The Oceania Club in Moudania of Chalkidiki, property of Sani SA, is the first hotel of the new group and forms also the concept of the new brand: ultra all inclusive. According to some sources the Gerakina Beach in Chalkidiki, the closed resort owned by the National Bank of Greece, could be one of the targets of the new scheme, where the Oaktree retains a majority stake.

- Also, in March the Hellenic Republic Asset Development Fund accepted the final bid of € 915 million of Lamda Development and Global Investment Group (comprising of Al Maabar from Abu Dhabi and Fosun Group from China) to develop the 6,200 acres of the former Hellenikon Athens airport, after 13 years of abandonment. It is estimated that the consortium will invest € 7 billion in total for the development of residential units, hotels, shopping facilities, theme & entertainment parks, art & culture museum, sports and leisure facilities, upgrading of the existing marina and beachfront etc.

- Finally, in April, the Astir Palace resort, which was sold by the Hellenic Republic Asset Development Fund (see Q4 2013 newsletter), announced that it has terminated the contract with Starwood Hotels & Resorts. The contract was in place since 1 July 2006.

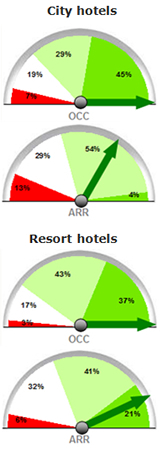

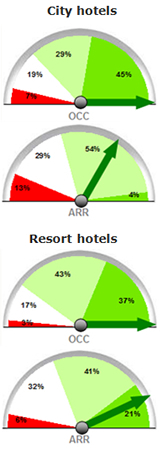

Barometer

- Finally, according to the GBR Consulting barometer for 2014 Q2 the hotel sector continues to be very optimistic for this year's season with significant improvements in both occupancy and room rates. In general the 2 and 3 star hoteliers are less euphoric.

Expectations for 2014

Endnotes

1 The international arrivals statistics are based on SETE calculations compiling the data from 13 major airports of Greece, representing 95% of foreigners' arrivals by plane in Greece and 72% of total foreigners' arrivals. Thessaloniki airport does not distinguish between arrivals of Greeks and foreigners.

2 RevPAR : Revenue per Available Room; for Greek resorts, calculations are based on TRevPAR (i.e. Total RevPAR).

Download this issue as:

- PDF (508 kb)

Back to newsletter