Greek Hospitality Industry Performance - 2nd Quarter 2014

Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

% Change in International arrivals1 in Greek airports, 2014 compared to 2013

Region |

% Change Q2 |

% Change YTD Q2 |

| Athens |

33.4% |

32.8% |

| Thessaloniki |

15.1% |

14.0% |

| Rest of Greece |

12.0% |

11.7% |

Source: SETE, processed by GBR Consulting

% Change in RevPAR2 in Greek hotels, 2014 compared to 2013

Region |

% Change Q2 |

% Change YTD Q2 |

| Athens |

31.1% |

27.4% |

| Thessaloniki |

17.9% |

12.0% |

| Resort |

8.0% |

7.8% |

Source: GBR Consulting

RevPAR in Competitive Destinations, 2014 compared to 2013

Region |

% Change Q2 |

% Change YTD Q2 |

| S. Europe |

7.5% |

5.3% |

| Rome |

4.1% |

3.1% |

| Madrid |

0.2% |

0.5% |

| Cairo |

|

-16.9% |

Source: STR Global, processed by GBR Consulting

Commentary

- In the first half of 2014 1.4 million international tourists arrived at the Athens by plane, 350,000 more than in the same period last year, an increase of +32.8%. We estimate that this increase translates into an additional 198,000 arrivals / 290,000 room nights / 435,000 overnight stays of international tourists at Athens' hotels. The total economic impact of this increase in H1 is estimated at € 98.8 million.

As a consequence occupancy levels increased significantly – reaching 90% in June – but room rates increased only moderately at almost 5%. ARRs are still 17% below the levels of 2007 – 2008 and also compared to other Mediterranean capitals, the Athens hotel sector remains one of the cheapest.

- Thessaloniki received 14% more arrivals by plane in H1, leading to strong improvements in occupancy, but at stabilising room rates. International airport arrivals in the rest of Greece improved 11% (+9% in the Dodecanese, +12% in Crete and +12% in the Ionian Islands). Overnights at hotels were at approximately the same number as in H1 2013, but managed at increased revenue per room.

- Rome and Madrid saw improvements in occupancy in H1, while room prices decreased. S. Europe showed an improvement in RevPAR of +5.3% as a result of improving occupancy levels and mild increases in room rates. Cairo continuously experiences falling demand.

Disappointing performance in May, targets for 2014 unchanged

- Bank of Greece estimates up to May 2014 show that 3.6 million foreign tourists travelled to Greece, up 17% from the same period last year. The main source markets of the United Kingdom and France were up with 26% and 14% respectively, while the number of Germans decreased with 6%. The number of Russian tourists increased once more with 39% until May 2014, but their per trip expenditure is considerably lower at € 760 per arrival (vs € 1,088 in 2012 and € 981 in 2013). The ongoing crisis in the Ukraine and the economic sanctions by the US and the EU have put pressure on the Russian rubble.

- Overall, tourism receipts up to May 2014 were up 10.6% due to strong increase in the months of January – April, while May – the first month of summer season – showed a disappointing increase of 0.8% with overall average expenditure down with 10.6%. The Association of Tourist Enterprises (SETE), however, does not revise its target of Euro 13 billion in revenue, up from 11.7 billion in 2013. Key infrastructure such as regional airports, cruise home ports, marinas and major convention centres need to be upgraded or created to attract more affluent visitors.

Ongoing privatisation of key tourism infrastrcuture

- In this respect the Hellenic Republic Asset Development Fund (HRADF) is progressing with the privatisation of key tourism infrastructure including 14 of the most important regional airports categorised in two clusters. Cluster A consists of the airports of Thessaloniki, Chania, Corfu, Zakynthos, Kefalonia, Aktio and Kavala and cluster B consists of the airports of Rhodes, Kos, Skiathos, Mykonos, Santorini, Samos and Mytilini. Large local and international groups have expressed their interest including Aeroport De La Cote d'Azur, Zurich Airport – J&P Avax, Athens International Airport, Fraport AG – Kopelouzos Group, Vinci – Ellaktor, Corporation America – Metka and Advent International.

- Furthermore, as reported earlier, HRADF is preparing privatisations for Greek railway operator Trainose and carriage maintenance company Rosco, for which the Russian Railways is interested, but various issues need to be solved with the Troika including its 800 million debt. Also ports and marinas are on the list of HRADF to be privatised.

Hotel openings and latest developments

- This summer three new upscale resorts opened their doors. On June 1, the 5 star Horizon Blu started operations. The property is located on the coast line of Kalamata and consists of 35 rooms, 15 of which have a private pool. The hotel has a Spa & Wellness centre and two conference rooms for a maximum of 450 pax. The restaurant "Dexia" has the signature of chef Ektora Botrini. The owners, family Papathedoridi, invested a total of € 6.5 mn. In July 2014 the 5* Grecotel Caramel Boutique Resort opened, which is located at a prime beachfront estate, near the Rethymno Venetian harbour in Crete. The resort consists of 36 junior suites, 18 suites and 14 villas. The luxury resort has a large pool, restaurants & bars and will operate from April – October. Finally, the Nikki Beach Resort & Spa, the first one in Greece, has opened. It is located in Porto Cheli, Peloponnese. The resort has a mix of 22 hotel suites and 44 serviced apartments, also available for long leases.

- In May 2014 it was reported that Electra Hotels had won a tender for the lease of a 6-storey building located at Mitropoleos Street in the area of Plaka in Athens. Formerly the ministry of Education was hosted in the building, which is owned by the Church. The € 15 mn development will have 220 rooms.

- The Emir of Qatar is planning on the island of Oxia, which he purchased in 2013 for € 5.6 mn, a luxury resort consisting of a 5* hotel, a boutique hotel, 2 villages, beach bungalows etc. According to reports of May 2014 the budget for the investment is estimated between € 250 – € 300 mn.

- In April Australian investors announced plans to build a mega luxury resort on the southern shores of the Greek island of Ithaca, which will include six luxury hotels with 1,020 suites, a marina to accommodate 200 yachts (and possibly cruise ships), an 18-hole Greg Norman designed golf course and a waterfront village. The international brands Setai Hotels and Resorts, Rosewood Hotel and Resorts and Rotana Hotels will make their entry in the Greek market through this development.

- Finally, HRADF has just concluded successfully the competition for the Afantou property, 185 ha in total with a 7 km coastline frontage, located at 20 km from Rhodes International Airport. The N. Afantou property, which includes the 18-hole golf course, has been awarded to Australia-based investor Angeliades for € 26.9 million. The S. Afantou property has been awarded for € 15.2 million to Aegean Sun Investment of the Cypriot family Nikolaidi, co-owners with TUI of the Atlantica Hotels and Resorts.

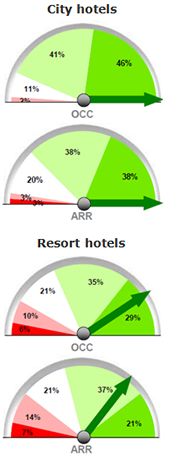

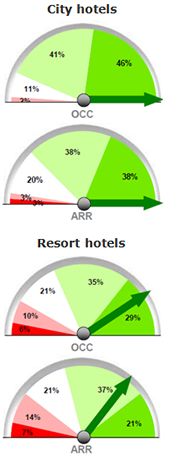

Barometer

- According to the GBR Consulting barometer for 2014 Q3 city hoteliers have a very positive outlook for Q3 2014 on all levels, while the resort hotels are slightly more cautious in their predictions.

Expectations for Q3 2014

Endnotes

1 The international arrivals statistics are based on SETE calculations compiling the data from 13 major airports of Greece, representing 95% of foreigners' arrivals by plane in Greece and 72% of total foreigners' arrivals. Thessaloniki airport does not distinguish between arrivals of Greeks and foreigners.

2 RevPAR : Revenue per Available Room; for Greek resorts, calculations are based on TRevPAR (i.e. Total RevPAR).

Download this issue as:

- PDF (408 kb)

Πίσω