Greek Hospitality Industry Performance - 2nd Quarter 2020

Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the

broader context of the international hospitality industry as well as of Greek tourism and Greek socioeconomic

developments.

Current status

- The Greek Government responded to the first Covid-19 case with a series of drastic measures leading to a total lockdown on March 23rd (see newsletter 2020 Q1). The closure of all hotels across the country was announced on March 19th and went into effect on the 23rd, with only few hotels remaining in operation to cover specific requirements.

- Gradual lifting of restrictions on movement and business activity started on May 4th, following a 42-day lockdown. The ‘Restart Tourism’ plan which included the re-opening of all-year-round hotels and camp sites as from June 1st and the re-opening of seasonal hotels from June 15th was publicized in late May.

- The planned reopenings were accompanied by the publication of a series of health protocols for safe operation of tourism establishments. Health protocols for hotels, rooms-to-let and campings were announced on May 22nd, 8 days before the opening of all-year-round hotels. Protocols for hostels and hot spring facilities were announced on June 15th and for the conference and meeting industry on July 3rd for a planned restart from July 1st. As of the writing of this report there are no protocols for the Short Term Stay market (AirBnB etc.).

- As from June 15th international travel restrictions were lifted for the Athens International Airport and from July 1st all Greek airports are open to international flights.

- Despite the opening, restrictions still apply on flights from some non-EU countries such as Russia, Israel, Qatar, the United Arab Emirates, Saudi Arabia and Northern Macedonia. Currently flights are allowed from Algeria, Australia, Georgia, Japan, Canada, Morocco, Montenegro, New Zealand, South Korea, Rwanda, Uruguay, Thailand, Tunisia and China (under reciprocity). Direct flights from Britain are allowed since July 15th and from Sweden from July 20th. The Government and EU are currently considering permitting flights from the United States at the end of this month.

- Land border crossings from Bulgaria are allowed through Promachonas border station, but as from July 15th travellers are required upon arrival to present a negative molecular test result (PCR) for Covid-19 performed not more than 72 hours before entering Greece. Entry through other border stations with Bulgaria is allowed only for essential travel. With regards to Albania, North Macedonia and Turkey, entry is allowed only for essential travel. As from July 6th Serbian citizens are no longer allowed to enter Greece. Arrivals by sea by ferry ships are allowed only in Patras, Corfu and Igoumenitsa ports.

- To facilitate tracing of visitors, as from July 9th all travellers are required to complete a Passenger Locator Form (PLF) at http://travel.gov.gr at least 24 hours before entering Greece providing detailed information. Travellers will receive a QR code on the day of their scheduled arrival in Greece.

Attica hotel sector: revenue loss during H1 2020 is estimated at € 300 million

- 2020 started well for the Attica hotel industry with higher revenues in January and February compared to the same months of 2019, while room supply was slightly higher.

- The forced hotel closure on March 23rd, reduced the number of available rooms in Attica to 73% in March 2020 and to 5% in April and May. In June - when hotels were allowed to open - just 21% of available rooms were in operation.

- In June occupancy levels of hotels in operation reached a level of about 26%, while occupancy based on full inventory (economic occupancy) was just 5%. By way of comparison, during June 2019 Attica hotels achieved an occupancy of 93%.

- The loss of revenue of the Attica hotel sector during H1 2020 compared to H1 2019 is estimated at € 300 million.

Thessaloniki: revenue loss during H1 2020 is estimated at € 50 million

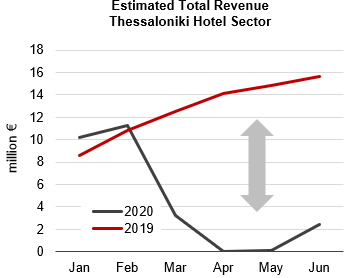

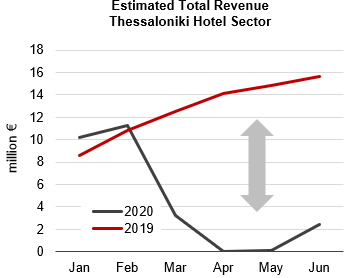

- Thessaloniki hoteliers also had a positive start of 2020 with higher revenues in January mainly due to improved occupancy.

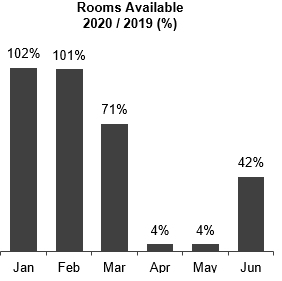

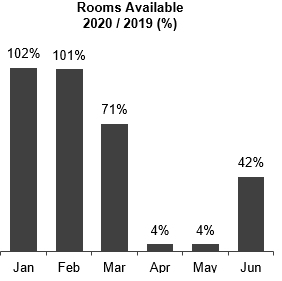

- The lockdown, reduced rooms in operation to 71% in March and to only 4% during the months of April and May. In June, 42% of the available rooms were reopened.

- Those hotels that opened in June recorded an occupancy level of 35%, while occupancy based on full inventory (economic occupancy) was 14%. Last year, the Thessaloniki hotels achieved an occupancy level of 79% during June.

- The loss of revenue of the Thessaloniki hotel sector during H1 2020 compared to H1 2019 is estimated at € 50 million.

Resort hotels

- Very few resorts opened during the 15 days to the end of June. Costa Navarino decided to re-open from June 17th, while the Kalamata airport was still closed for international flights, and thus the resort was targeting for domestic clients. The Nafsika hotel of the Four Seasons Astir Palace Hotel on the Athens Riviera opened on June 12th. Similarly, Grecotel’s 5-star Astir Alexandroupoli and the 5-star Poseidonion Grand located on the island of Spetses opened on June 15th and 17th respectively.

- With international air traffic resuming at all airports from July 1st, more resorts are re-opening. Larger chains have decided to open some of the hotels in their portfolio, while others have decided to remain completely closed this year.

- Airport traffic, however, shows that demand remains low. Kathimerini reported that passenger traffic at the 14 regional airports managed by Fraport (Thessaloniki, Rhodes, Kos, Corfu, Chania, Santorini, Mykonos, Lesvos, Zakynthos, Kefalonia, Samos, Skiathos, Kavala and Aktion) dropped by 84% y-o-y during the first 12 days of July, with a 62% drop in domestic traffic and 88% in international traffic.

Transactions

- In June Henderson Park, the European private equity real estate investment platform and Hines, the US-based real estate firm acquired from the Kefalogianni family the Cyan Group of Hotels for

€ 61 million, a price that corresponds to approximately € 86,000 per room.

- The Cyan Group portfolio includes the 5-star Apollonia Resort & Spa (336 rooms) and the 4-star Santa Marina Beach Hotel (208 rooms) and the 5-star Sitia Beach City Resort & Spa (162 rooms), all located on the island of Crete. The hotels will be upgraded with a budget of € 30 million and the Y&T Daskalantonakis Group will be managing and operating the hotels.

- Henderson Park and Hines also completed their acquisition of the 4-star Hermes and 3-star Coral, two hotels with 218 and 170 rooms respectively. The two hotels are centrally located, adjacent to each other, in the coastal city of Agios Nikolaos in Crete.

- The acquisitions bring the Henderson Park and Hines hotel portfolio to 5 seafront properties in Crete offering 1,094 rooms and the 5-star 309-room Grand Hyatt hotel in Athens.

Other developments

- The Government is eagerly pushing pending projects through the bureaucracy to get them underway. The long awaited former Hellenikon airport project in Attica started with the demolition of the first of 990 buildings on the site on July 6th.

- Construction works of the € 120 million development of Kassiopi in Corfu by NCH Capital began on June 19th and a publicity event with the Prime Minister in attendance followed on July 11th.

- Dolphin Capital’s Kilada project in Argolida - Peloponnese was launched publicly on June 19th. This project is the first tourism investment in Greece to be included in the strategic investment law with building permits issued in 15 days.

- Mid-July the Greek Government approved eight strategic investment projects in the tourism sector, three of which are initiated by Greek American former financier Angelos Michalopoulos, who has acquired large swathes of Ios Island. The approved projects involve a 5-star hotel complex in the area of Koumbara – Diakofto (budget € 43 million), a 5-star boutique hotel and holiday homes in the area of Pikri Nero (budget € 45 million) and two hotel complexes in the area of Papas-Loukas-Manousos-Peti-Hamouhades (budget € 90 million).

- The other five strategic investment projects involve a marina in Vlyhos, Lefkada (budget € 70 million, Municipality of Lefkada), a hotel complex in Barko, Aktio (budget € 107 million, RND Investments Greece), two hotels – Raffles Mykono & Fairmont Mykonos) – in Mykonos Island (budget € 104 million, White Mulberry Development IKE) and a resort in Castro, Kylene in Ilia, Peloponnese (budget € 104 million, Killini SA). Finally, it was also decided to include the € 410 million Elounda Hills project in Crete in the strategic investment procedure.

- At the end of May the Council of State approved the draft Presidential Decree for the development of a 5-star resort on Karpetis Beach, west of Kalo Livadi beach on the island of Mykonos. The € 51 million investment of AGC Εquity Partners under the Special Plan for the Spatial Development is known as the “The Mykonos Project”.

- In the area of Platy Gialos, Mykonos Island the Central Council of Urban Issues and Disputes approved an investment of € 40 million for the development of a 200-bed hotel. Investors, E. Daktylidis SA, Zeus of Marios and Vangelis Daktylidis are well known hoteliers on the island.

- Construction at Costa Navarino continues as planned (see also our newsletter of Q3 2019) with two 18-hole golf courses in Navarino Hills and a 99-room and a 192-room hotel in the area of Navarino Bay. With 26 of the 50 villas of the Olive Grove and Sea Dunes communities sold, the Group announced the “Rolling Greens” villa community. The construction of the 42 units ranging in size from 235 to 295 sqm will start later this year.

Download this issue:

- PDF 188 kb

Πίσω